TO ALL UNION MEMBERS OF SEIU, HERE IS SOME PENSION FUND DATA THAT MIGHT INTEREST YOU.

Dear SEIU 620 UNION MEMBER

Hello my name is Larry Mendoza and I phoned you today about the SBCERS pension fund and questions I have on it's TRUE value. People are very concerned with this issue and I have already appeared on T.V. twice most recently last October in Santa Maria. I am due back to share and update the public with my latest findings next month. I will also be writing an editorial for a parent journal regarding parent/educational issues in California next month. I have spent months researching data and that would best be presented in a sit down meeting. Marcelino there are just to many contradictions in value and the return on investment were just too strong for the pension fund to be underfunded at this current day and time.

All I ask is that you please print the attachment I have forwarded and review just a few quick points. Very simply look at the top left corner of the attachment and find the column that shows the fund value for 06/30/98 which is just exceeds 1 billion dollars and I have pasted it below. Than drop lower on that same page and look under the "summary of funding position". follow the summary from right to left for 12/31/98 and that shows the pension fund value does not even reach 800 million. So than how is it that six month earlier the fund value was 263 million dollars higher on 06/30/98?

The attachment page was taken from the reports that the State of California keep @

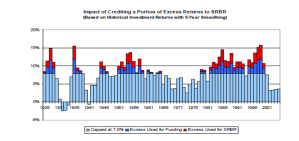

DEAR UNION MEMBER, this next chart reflects data from 1981 through 2000 for the SBCER pension fund and it's returns on investment. The funds performance during that time exceeded the assumption rate by a full 3.50% . The return during that period was 11.4% and the assumption rate at that time was only 7.9%, there should have been no issues with the funds value other than it being under reported. The fund has a assumption of a" real net return" of between 3.25% and 3.50%, so what the 11.4% return shows us is that the fund doubled there "real net' need for 20 straight years!

|

| THEIS CHART REFLECTS A WELL FUNDED PENSION PLAN FOR A FULL 20 YEARS WHICH ALLOWED 180 MILLION DOLLARS IN "EXCESS RETURNS "TO BE PULLED IN THE YEAR 1999. |

DEAR UNION MEMBER, have you ever read County Controller Robert Gies's "White Paper"? It was writen in 2006 to clear up issues people were having with the pension. There is so much to discuss about how Mr. Geis informs us just how the pension fund is raped. Now I don't think that was his intention but after I read it I have to be honest I asked myself why did he even bother? Just a few quick points here and I will be done. The next examples here where taken from that letter and you can find it at @ http://www.countyofsb.org/auditor/Publications/CountyRetirementCosts.pdf. In the two boxes below taken from page 2 both have no 12/31/01 date or value for the pension. How can you balance a check book with missing data? Also you can see that the value reporting date was switched from 12/31 and the year to the now commonly used 06/30 and the year. Underneath these two boxes is my favorite part of the "White paper" when it says; " This is not an actuarially sound practice because "excess earnings" are not equivalent to surplus earnings". It goes on to say how this practice takes from the pension fund but is than added back to the unfunded liability side at a new cost to the taxpayers. I have so much more to share and hope you are interested in a face to face meeting.

Regards

Larry Mendoza

805-636-2302

No comments:

Post a Comment